PAYBACK TIME

Airlines played a key role in designing the first card payment schemes. Over time, the industry has left your needs behind. We are here to pay you back.

What is their deal?

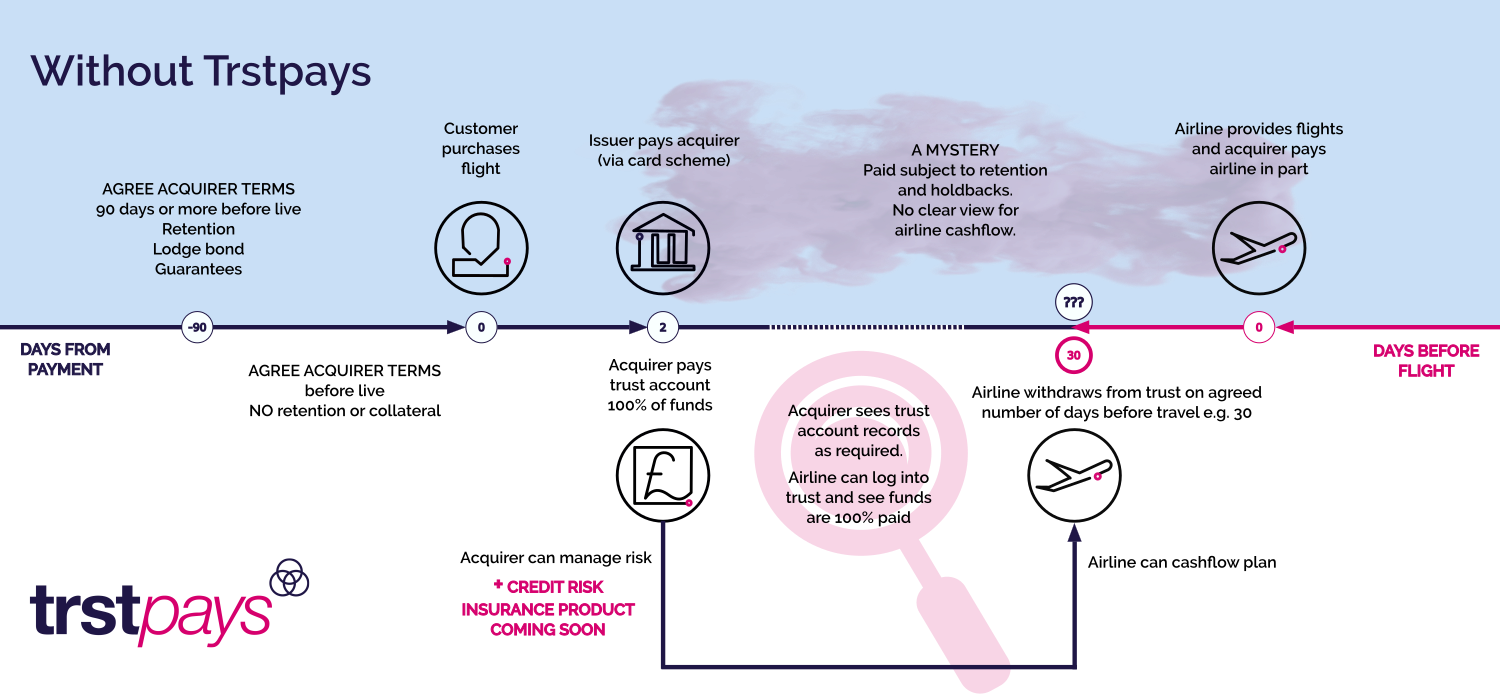

- Notable airline failures have driven payments providers away.

- Payment companies think of airlines as one huge credit risk.

- Remaining providers avoid risk by demanding your collateral, or holding back payments in rolling reserves, or both!

What about you?

- You are running a low margin business in a competitive industry.

- Collateral is a huge cost of capital and delivers no return.

- Bad payment terms means you don’t get the cashflow you expect when you expect it.

EUROPEAN AIRLINE

- One of our customers, wanted to place $75m (part of their volume), but had $5m in collateral with their old payments provider. This was reduced to zero using Trstpays and one of our payment partners.

- Our panel of payments providers (also known as acquirers) are experts in the airline sector, and together we can put your airline back in control of your payment strategy.

CAN YOU AFFORD NOT TO?

“IATA’s financial settlement systems handle around $400 billion per year. Of that, around $7.7bn goes in banking fees. While 7.7 of 400 may not seem like a huge percentage, $7.7 billion is more than 20% of the estimated net profit of the entire global airline industry in 2016 ($34.8 billion).”

CAUTION: A RISKY GAME

Payments providers (acquirers) are increasing security demands. Geir Karlsen, the former CEO at Norwegian Air Shuttle, recently stated:

“In a normal situation we should probably have about £350m to £400m more liquidity than we currently have in a normal holdback situation with credit card acquirers.”*

In their 2019 half-year report, Flybe state:

“Existing card acquirer contracts enable them to call for up to 100% cash collateral and additional card acquirers are actively being sought.”

The uncertainty these clauses creates can be catastrophic. Reducing cashflow from struggling businesses means failure becomes a self-fulfilling prophecy. And everyone loses. By creating trust in the relationship, Trstpays improves stability for both parties. WIN-WIN.

*Financial Times 2019, Norwegian Air Shuttle’s new boss battles to save struggling airline

WE SEE YOUR POTENTIAL

“The number of flights performed globally by the airline industry increased steadily since the early 2000’s and is expected to reach 40.3 million in 2020. This figure is over one million higher than the prediction for the previous year and

represents an increase of over 50 percent from a decade prior.”

E. Mazareanu, 2019, Airline Industry Number of Flights, viewed Dec 19