WINTER HOLIDAY COMPANY

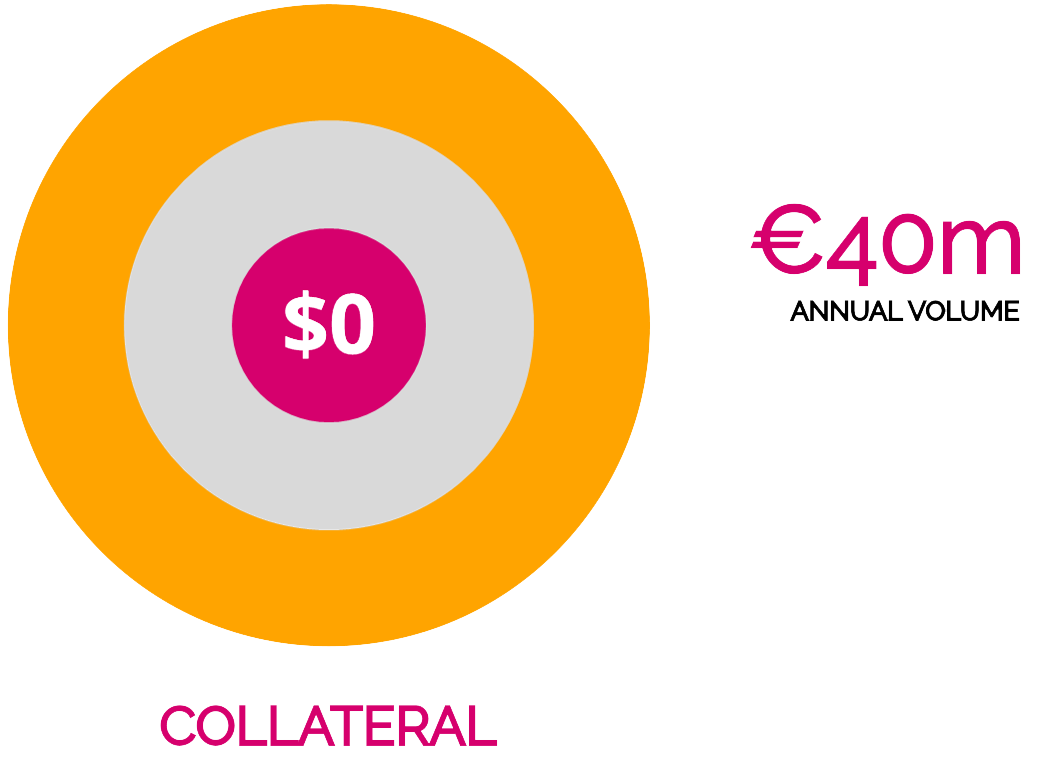

- One of our customers, with an annual volume of €40m, had €2m in collateral and 10% rolling reserves with their old payments provider. This was reduced to zero using Trstpays and one of our payment partners.

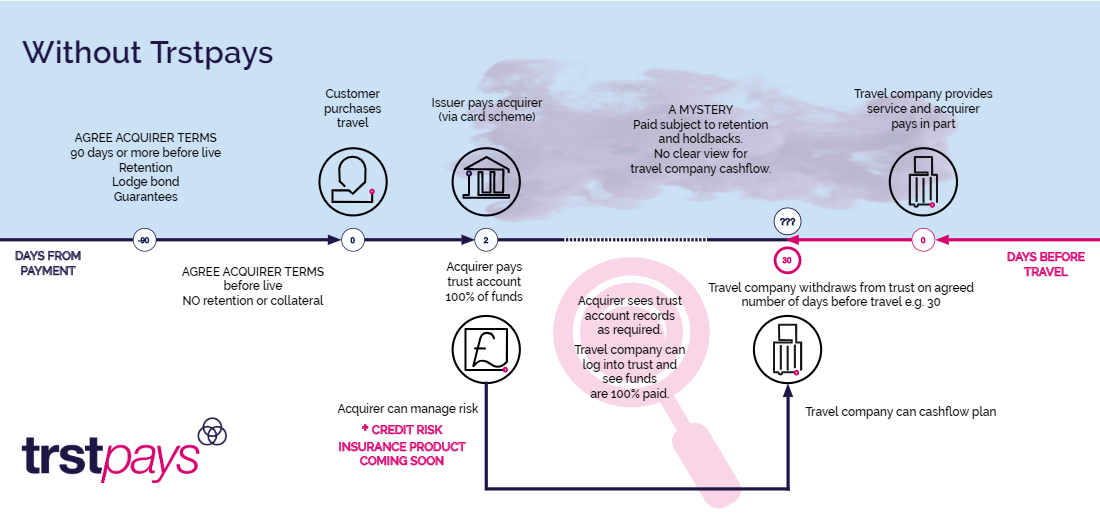

- Our panel of payments providers are experts in the travel sector, and together we can put your travel business back in control of your payment strategy.

CAN YOU AFFORD NOT TO?

Given recent events with Thomas Cook we are finding a lot of interest in this opportunity and it may be something that helps you too. High volume merchants that have high credit exposure may struggle to get commercial terms with any payments provider.

We know many travel businesses have trigger clauses in contracts, whereby additional security demands can be imposed almost on a whim. The uncertainty these clauses creates can be catastrophic. Reducing cashflow from a struggling businesses means failure becomes a self-fulfilling prophecy. And everyone loses.

By creating trust in the relationship, Trstpays improves stability for both parties. WIN-WIN